Electric Car Benefit 2025/24. Electric vehicle tax savings highlight. Tesla is making a push toward fleet vehicles as cost of operation reaches a tipping point for electric vehicles — led by the model 3.

The 2025/24 new tax year starts on 6th april 2025 until 5th april 2025. Automatic | 2025/24 | petrol | 4,000 miles.

With the increased recent focus on achieving net zero, the government is planning to ban new petrol and diesel car sales by 2030.

First Buick Electric Vehicle In 2025, Full EV Lineup By 2030, Hmrc views company cars as a taxable benefit and the amount of tax you pay depends on several factors, including the purchase price of the car, how much co2 it emits. However, electric cars are now causing companies and employees to reconsider their position on company cars and fleets.

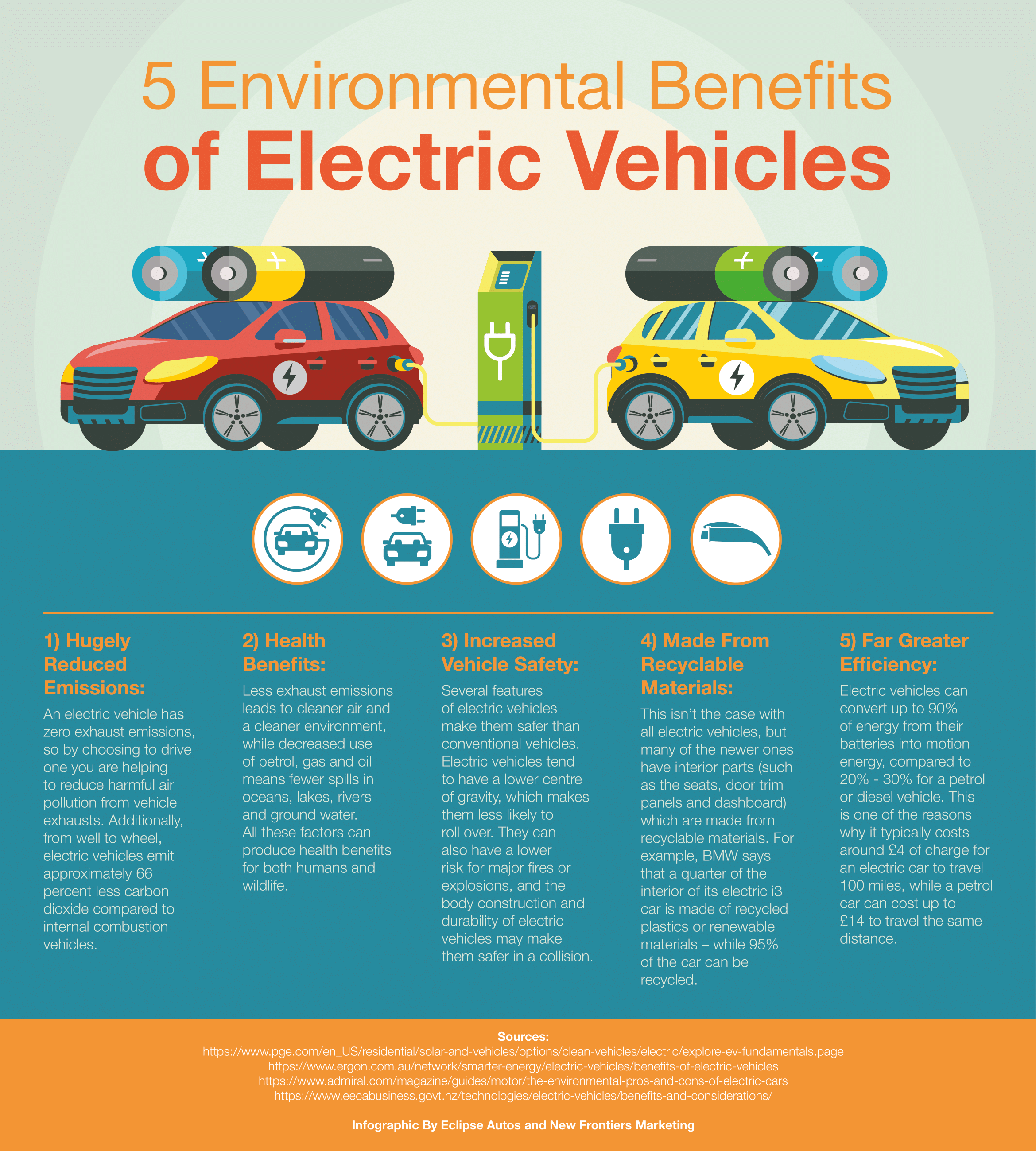

5 Environmental Benefits Of Electric Vehicles, Hmrc electric car mileage rates 2025. Understanding benefit in kind tax on electric company cars anglia car, the present bik rate for electric cars is 2%, and it will remain at 2% for the 2025/24, and 2025/25 financial.

Electric Cars The Way For A Sustainable Automotive Industry, Hybrid cars are treated as either petrol or diesel cars for advisory fuel. The 2025/25 new tax year starts on 6th april 2025 and ends 5th april 2025.

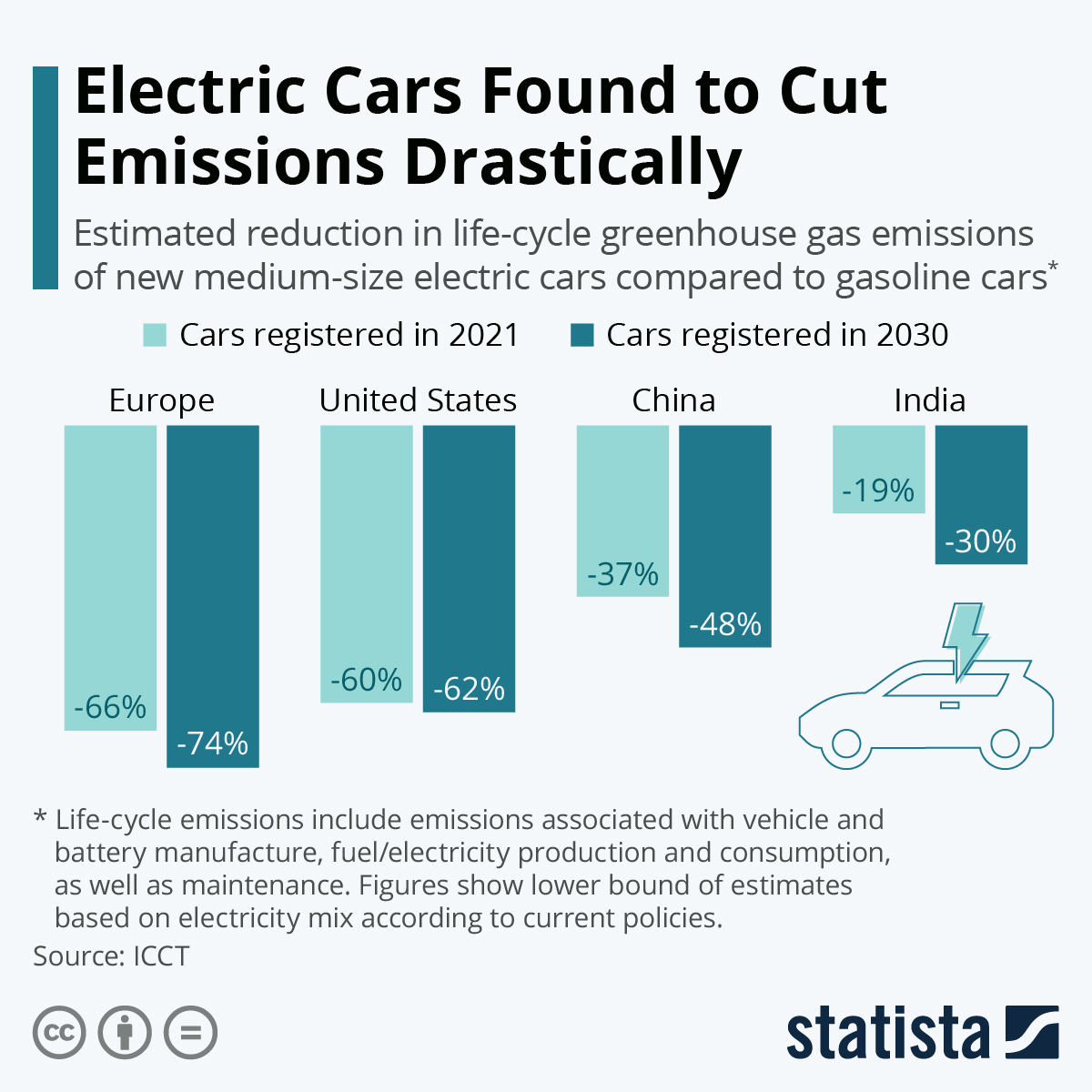

Chart Electric Cars Found to Cut Emissions Drastically Statista, However, electric cars are now causing companies and employees to reconsider their position on company cars and fleets. For electric cars, benefit in kind tax is only 2% until 2025, rising by only 1% each year until 2028.

Electric Car Benefit In Kind 2025/25 Candra Abigale, Employee b enjoys an 86% reduction in benefit in kind liability compared to employee a. The 2025/24 new tax year starts on 6th april 2025 until 5th april 2025.

Top Rated Electric Vehicles 2025 Marlo Shantee, The ultimate guide to electric car benefit in kind we power your car, the ultimate guide to electric car benefit in kind we power your car, electric car benefit in kind. If your business owns a fleet of fully electric or hybrid vehicles, the rate is 9p per mile, rising from 8p earlier this year.

How many electric cars are on the roads and where are they? World, The bik tax depends on your electric vehicle and the rates tend to change each tax year. Employee b enjoys an 86% reduction in benefit in kind liability compared to employee a.

New Electric Cars 2025 Vonni Ernesta, Electric vehicle tax savings highlight. From 1 june 2025, the advisory electric rate for fully electric cars will be 8 pence per mile.

7 Benefits Of Electric Vehicles To The Environment Auffenberg of, The 2025/25 new tax year starts on 6th april 2025 and ends 5th april 2025. With the increased recent focus on achieving net zero, the government is planning to ban new petrol and diesel car sales by 2030.

Toyota 2025 Electric Car Aila Lorena, The pledge is included in its roadmap to. The 2025/24 new tax year starts on 6th april 2025 until 5th april 2025.

With the increased recent focus on achieving net zero, the government is planning to ban new petrol and diesel car sales by 2030.